Health Savings Accounts: Trends, Benefits, and Useful Insight

Open Enrollment Season is upon us, and many employers are reviewing all plan options for the 2025 benefit plan year. Which benefit plans will offer the greatest benefit to your employees, all while staying competitive and fair? Deciding on the plan offerings for your employees is a big decision: now is a great time to dive deeper into the pros and cons of one benefit in particular: Health Savings Accounts.

1. What is an HSA?

A health savings account, or HSA, is a tax-advantaged savings account that lets all benefit eligible employees with high-deductible health plans set aside pretax dollars to pay for qualified medical expenses. Employees can contribute to an HSA up to the annual maximum and either use those funds to pay for qualified healthcare expenses now or let that balance build. HSA funds roll over from year to year, never expire, and will stay in their account until funds are used.

2. Who can contribute to an HSA?

The IRS defines the following requirements to be eligible:

· Since the employee must be enrolled under a high deductible health plan (HDHP) to be eligible, it would be wise to consider including a HDHP plan to your medical offerings if not already. It will be up to the employee to select this medical option if they are interested in participating in an HSA.

· Employee must not be enrolled in Medicare.

· Employee cannot be claimed as a dependent on someone else’s tax return the year prior.

3. How does this differ from an FSA?

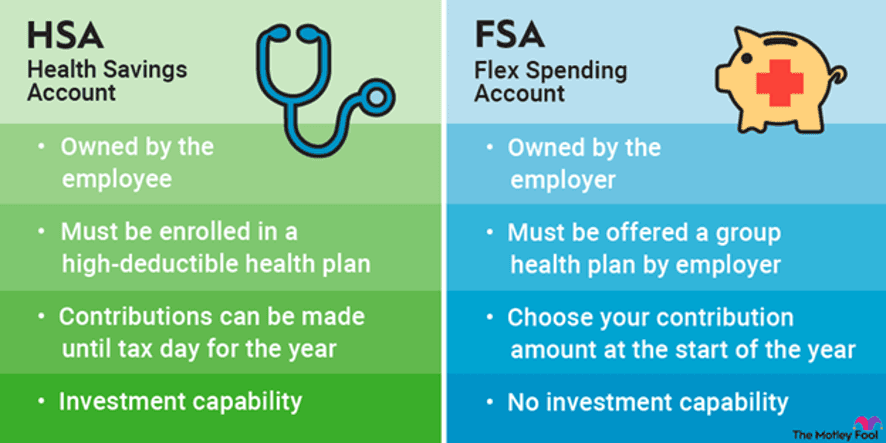

Both FSAs (Flexible Spending Accounts) and HSAs are tax-advantaged accounts that can help lower income taxes while providing funds for medical expenses, however the two differ significantly.

· FSA accounts are employer-sponsored, while HSAs are owned by the individual, and can be enrolled in either through their employer or on their own. In other words, employees may participate in an HSA without an employer sponsorship, however offering this as a part of the entire benefits package will only provide a more robust and attractive benefit package, as well as providing ease to the employee where elections can happen all in one place.

· HSA funds roll over year-to-year, as well as from employer to employer. This flexibility is likely to increase employee participation. FSA funds are forfeited at the end of the year, with a grace period until March of the following year to submit any claims from the previous year.

· HSA funds can earn interest and grow, FSA balances cannot.

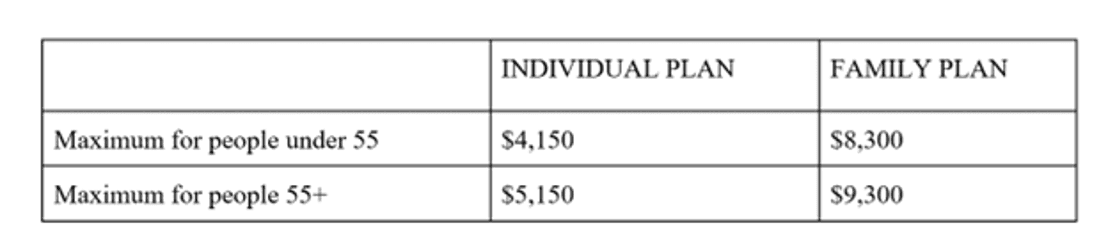

· HSAs often have higher contribution limits than FSA accounts. The 2024 Health Savings Account (HSA) contribution limits are $4,150 for individuals and $8,300 for families. The 2024 FSA limit for individuals is 2024 is $3200, while the Dependent Care FSA (DCFSA) maximum annual contribution limit is $5,000 per household.

· With an FSA, the full year's contribution is available to the employee immediately, while with an HSA, funds are only available after being deposited. From an employer perspective, an HSA offering is “safer” when it comes to attrition since HSA funds can be contributed per paycheck.

· FSA funds cannot be withdrawn for non-medical expenses, whereas HSA funds can be withdrawn for non-medical expenses, with tax and/or penalty.

· FSAs can be used with any health plan, but HSAs require an HSA-qualified high-deductible health plan (HDHP).

· FSA contributions must be decided by the employee at the start of the year, whereas an HSA contribution can be changed at any time.

(https://www.fool.com/retirement/plans/hsa/hsa-vs-fsa/)

4. HSA 2024 IRS contribution Annual limits:

5. Things you may not know about Health Savings Accounts:

· There are over 180,000 ways to use HSA funds; including vision & dental expenses & over the counter healthcare products.

· Employees have control over contributions: amount, when, and how. Employees can change, stop or pause any recurring contributions at any time, or make one time contributions.

· There is no time limit for reimbursements.

· With many HSA providers, there is a mobile app that can automatically create digital copies of receipts, recognize HSA eligible expenses, give real-time notifications of purchases and contributions, & provide instant reimbursement of expenses to direct deposit.

· There are no required minimum contributions. Employers do not need to contribute at all- it is your choice.

· If employees make contributions with after-tax dollars, they can deduct the money from their gross income on tax returns, reducing their tax bill for the year.

6. What are the main benefits of offering a Health Savings Account (HSA)?

From a business standpoint, there are many benefits to offering an HSA to your employees:

· Offering a health savings account alleviates some of the stress of unexpected medical expenses for your employees.

· Tax savings: As an employer, you have the option to contribute funds into employee HSA accounts in addition to any employee contributions, as long as you are within the annual maximum. Any employer contributions to an HSA is not considered payroll and thus does not come with associated payroll taxes, as well as any contributions are tax deductible, which is exclusive to employees and employers.

· Many times, HDHP plans have a higher deductible, and therefore a lower premium. This in turn saves in premium cost for both parties, and employers can use any savings to either allocate to employee HSA accounts or save in budget.

· Many employees and job seekers alike are recognizing the value of a savings account for any unexpected healthcare costs that can be used now or in the future. It’s likely that adding this to your list of offerings will be attractive to candidates to join your company.

· HSAs are easy to transfer should you switch benefits providers or plans year over year, so you won’t be locked into any one plan due to offering an HSA.

· Employees do not need to pay taxes on funds held in their HSA account.

7. Things to consider:

· A High Deductible medical plan, which is required for an employee to qualify for an HSA, typically has a greater deductible than other medical plans, such as a PPO, so our advice is to review all options and offer additional medical plans outside of a HDHP plan so that employees have a choice.

· Employees will want to be mindful about budgeting for any recurring contributions carefully, because if funds are withdrawn for non-qualified expenses before the age of 65, they’ll owe income taxes and incur a 20% penalty.

· Some HSAs charge a monthly maintenance fee or a per-transaction fee, which varies by institution. This detail will also want to be shared with employees.

If you’d like to learn more about HSAs or want to review your current benefits offerings, give us a call! Our team is here to help you select plans that best support your business and your team members.

Happy Open Enrollment!

The Renewed HR Team

Resources:

fool.com/retirement/plans/hsa/hsa-vs-fsa/

Investopedia/articles/personal-finance

irs.gov/publications

Source-Health Equity

Get expert help

5.0

Score on GOOGLE